Localization Leadership – Exclusive to Vistatec.com

Empty headin

Communicating the Right Localization Data for Business Decisions

Align your localization agenda to corporate goals. To be strategic, you should be able to easily draw a straight line from your company’s business objectives to everything your localization department does

– 5 Core Principles to Establish Yourself as a Localization Leader, part one of Vistatec’s Localization Leadership series

This quote remains as accurate as ever. Understanding where and how localization fits into your company’s growth plans is critical. This article dives deeper into one of the five core principles outlined in part one of our series: leading with data.

Business Decision Drivers for Localization

Maybe your localization operations are already a well-oiled machine. You are on top of every project. Vendor relations are rock-solid. Linguistic quality is outstanding. Your stakeholders can always count on your team to deliver what you promise. It is an admirable accomplishment.

Yet it is not enough.

You must ensure that your company understands what drives localization business decisions and how they should think about them. You must instill confidence in your stakeholders that when you make a recommendation or ask for budget, that you have done your homework and that the recommendation or request supports the wider business objectives.

This article is designed to prompt ideas that help you:

- Build a meaningful understanding of the business-driven data that guides localization decisions so that this understanding can also be shared across the company. This data influences the size of your budget and promotes an understanding of why your budget is being spent in the manner it is.

- Form strategies to communicate these topics horizontally to colleagues and vertically to your management chain. Transferring this knowledge to all staff is a concrete way to facilitate the company’s global success.

Your goal is to identify and communicate data that highlights how your localization activities support company growth. As outlined in our article on How to Capture and Measure Relevant Localization Metrics, you want to make a concerted effort to harness your KPIs and team metrics to demonstrate how localization is contributing to your company’s overall strategy.

After reading this blog post:

- You will better understand how to frame localization on a more widely understood, business-driven level.

- You will be able to better prepare and account for your budget and budget requests.

- You will be equipped to answer many of the typically difficult questions thrown your way.

Selecting the Right Localization Data for Sharing Internally

Let’s start by looking at the data you want (and don’t want) to communicate. We will then illustrate how you might want to use that data in specific meetings to further strengthen your positioning.

The Data You Want to Communicate

What percentage of your company’s revenue comes from non-English speaking markets?

This is generally helpful information to put at the beginning of any presentation. It is a simple and memorable reminder to everyone that your business relies on non-English speaking customers. Be careful, though: Do not confuse “international revenue” with non-English-speaking country revenue. If Ireland, Australia, and other English-speaking markets are in your “international” bucket, do not forget to remove them from the total.

This is the most accessible data, and the finance and analytics teams are your best partners for acquiring it.

What percentage of revenue comes from each country?

Now things start to get interesting. It can be startling the first time you review this data as a localization leader. This is the data that can drive home the astonishing fact that your localization spend for one locale contributing 2% to the total revenue might be the same (or even more) than a country pulling in 10% of your total revenue.

Acquiring this set of data might take more effort than you would think. Many larger companies like to break down their revenues by region instead of country. If the obvious departments claim not to have this data, we encourage you to keep digging.

Build and maintain relationships with your regional sales and data analytics teams. Your BI colleagues can often supply you with data, charts, and graphs they so expertly create. If this data is considered confidential at your company, you can remind them that the audience is internal only. Spend some time making sure the folks from Finance, Analytics, etc., understand why it is so important and how it is used to support the company’s growth goals.

What are the annual growth goals/forecasts for individual countries?

While your company might have a single global growth goal (divided by region), future goals or forecasts for individual countries can also be challenging to obtain. Showing recent sales and growth is good, but showing change over time in sales is the gold standard for business decisions about future strategy and spend. If Finance does not have individual countries’ future goals, you might need to expand your reach. Sales (corporate and in-country), Marketing, and Product are excellent sources of such data. While many factors go into these projections, remember that you only need a final number: the company’s desired growth in the respective country expressed as a percentage.

It is preferable to get more granular here. Namely, how much did the localization team spend for each language by content type and function? The need for this type of information might inspire you to make sure your data is clean and accurate!

Remember that you will present your total spend by language to most of the company. Spend by content type is helpful to bring into meetings with the departments that own that content – it gives them a more detailed look at their world.

Competitive data

While not immediately apparent, keeping management informed of what your global competitors are doing can prove powerful. There’s value in knowing what customers seek from a product or service, and comparing the language support your competitors provide can be interesting.

Localization (or better still, Sales and Marketing) should always work with regional or country resources to identify the pain points for key customers, which could be solved with a more robust localized product or offer. Keeping an eye on your competitors’ localization practices can strengthen an argument or reveal an opportunity to do more. Plus, working with in-country resources has the added benefit of demonstrating that you know the colleagues most impacted by your team’s work.

The Data You Do Not Want to Communicate

The myth of pure ROI calculations in localization

One illustrative metric that all businesspeople understand is a return on investment (ROI). However, ROI for localization is not always directly calculable and sometimes must be inferred.

If sales in Egypt jump 30% after localization, you may have difficulty tracking down what part(s) of localization are responsible. But the evidence is strong that localization drove that ROI in Egypt. For bonus points, explore other alternative sources for the sales increase and be prepared to provide valid reasons why localization is more likely the main contributor. In an inferential ROI scenario, you may need to take the next step and connect the dots for your audience. Exploring possible counterarguments and having solid responses to them is an effective way to show that your analysis is more than just surface deep. Be clever; give your audience an “aha moment” when they suddenly respect your analysis and thinking processes.

No one* cares about operational localization metrics

There is always a temptation to show off the details of your localization quality assurance processes, translation memory savings, improved turnaround times, and other similar metrics to prove the importance of localization. While beneficial to you and your team, they are of little interest to the rest of the company. Almost everyone cares about the results; but few people care about the process.

*The exception here is Finance. In addition to the data suggested above, exposing your finance team to everything you have relating to cost savings and efficiency gains is a solid strategy.

Consolidating Your Data

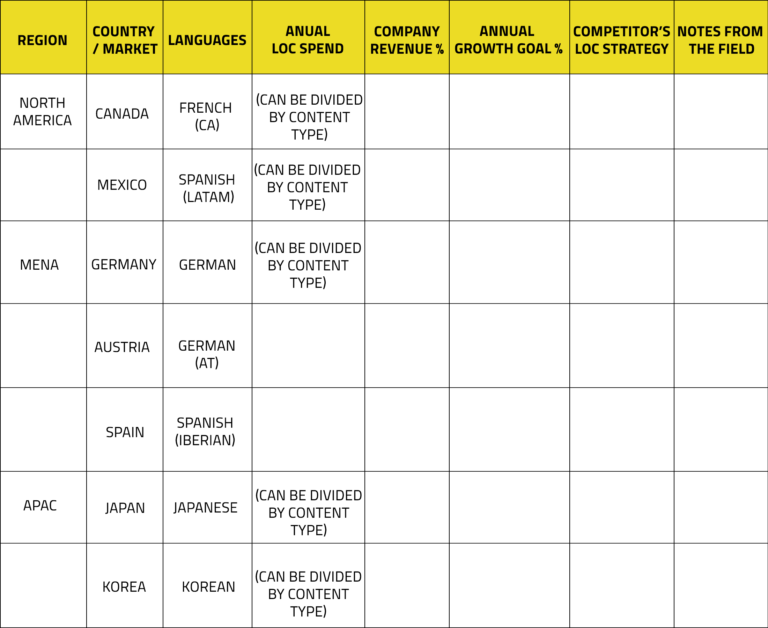

The format you choose to reduce and maintain all your information is up to you. While we will use the example of a spreadsheet below, your structure will be driven by what makes the most sense in conjunction with your internal workflows.

Now is also a great time to remind you of the prime “alignment” directive: There is a straight line from your company’s business objectives to localization. Your “how localization supports the company” document can be sliced and diced depending on your audience.

The following is a simple spreadsheet example that is easy for your audience to digest but also summarizes the key data in one glance. Individual languages could be broken out by content type or, if applicable, by country.

Tailoring Your Data to Different Meetings and Desired Outcomes

Once you have compiled and consolidated the correct localization data, it’s time to tailor everything for the specific type of meeting and stakeholders you’re presenting it to. As you plan your next meeting, it is essential to consider who will attend and stay focused on what you are trying to achieve.

Are you looking for a buy-in? More budget allocation? Headcount? Or do you need to demonstrate accountability for how your localization strategy in the Indonesian market aligns perfectly with the company’s quarterly growth goals? Whatever your case may be, tailoring your data to your audience and the desired outcome of the meeting should be part of your communication strategy.

The following communication frameworks should be tweaked to align perfectly with your corporate reality. There is no one-size-fits-all approach. For each meeting, take the time to construct the presentation of your information in as eye-catching a manner as possible. Data is mostly numbers, so do what you can to bring them to life!

Communicating Localization Data in Meetings with Your Direct Manager

After the initial development of your data format, bring the entire dataset to the first meeting with your direct manager. Make it clear that you are tying localization to company goals and providing a new way for the entire company to perceive its business and internal investments.

This first meeting is a fantastic opportunity to get feedback. Some straightforward questions to ask your manager might include the following:

- Is the data clear?

- Can you see how it ties into our corporate goals?

- Do you understand how this will allow us to defend or hone upcoming localization budgets?

Sharing Localization Data in Meetings with Your Stakeholders

Here, we define a stakeholder as the person or department who owns the content you are localizing or is impacted by your efforts. Examples of stakeholders include folks from Marketing, Product, Support, or Sales. These stakeholders often (though not always) control the budget as well.

For these meetings, a combination of language strategy plus the critical data you have uncovered opens a world of meeting topics. If you are worried about confusing stakeholders by showing data for each content type, only present the data that pertains to them.

Each of the following topic examples displays your effectiveness as a true thought leader; each one shows that your goals are directly tied to those of the wider business enterprise. The data you have just presented now seamlessly informs stakeholders why the question is being asked:

“We currently do not translate Japanese support articles, but the growth target for Japan is high, and the competition thinks it’s an investment worth making. Should we change our language strategy to systematically translate support articles into Japanese?”

“Our annual growth in Norway is low, and the forecast is not expecting much more growth. We spend much more money translating Norwegian blog posts than we do for far higher-growth countries. Should we pull the plug on the Norwegian blog?”

“The company is mandated to grow in Southeast Asia by 10%. We do not currently translate our app into Thai or Vietnamese. Given the size of those markets in that region, how will we meet our corporate growth strategy if we do not localize in those languages? Is doing so worth our consideration?”

It is worth noting that bringing a stakeholder’s clearly defined language strategy to these meetings is a fantastic way to provide an even deeper business focus and meaning to them. You can easily insert a “language (or market) strategy” column into a data table like our previous example. The combination of data and language strategy gives stakeholders a more holistic context for where they currently stand and where they might want to take localization.

Meeting with Your Manager’s Peers and Leadership

When meeting with the C-suite or your manager’s peers, your data must be distilled. While you will always want to have the entire dataset handy, just in case, use a few words, images, or simple graphs to describe the data and your meeting goals. You might wish to include the following concepts in your presentation:

- X% of the company’s revenue comes from non-English speaking countries.

- Localization works to support the company’s greater goals.

- We collaborate with individual stakeholders to address their current and future localization needs.

- We partner and make localization decisions with stakeholders based on data; examples could include the current language strategy, past/future growth by locale, localization cost, and each country’s competitive situation.

Although your presentation in this meeting scenario will be simple, you will want to dedicate a reasonable amount of time before the meeting to consider what is essential to each attendee.

- Be prepared to give specific examples of how stakeholder meetings have changed the language strategy and budget.

- Become as fluent as possible in current and future budget requirements.

- Be prepared to talk about how evolving technologies are influencing your thinking.

- If you are asking for something (additional budget, headcount, etc.), be as concise as possible.

Financial Meetings

When preparing for a meeting with Finance or whoever owns the localization budget, treat it as if you were meeting with your manager’s peers or leadership. Two additional steps should also be considered beforehand:

- Here again, this is a meeting to discuss localization efficiency gains. Earn the confidence of financial gatekeepers by demonstrating your operational brilliance!

- Prepare anecdotes like “Product Development let us know we will add four new languages in Q2. Customer Service and Marketing are committed to supporting these new languages right after launch. This explains our need for X% additional funding.”

Leading meetings with curated data for your attendees and which supports your desired outcome is essential for making the most of the time spent in a meeting—and making it a success. Compiling and consolidating the correct localization data will provide context, help build stakeholder consensus and buy-in, and make it easier for you to authoritatively illustrate how your localization strategies, financials, and KPIs align with your company’s growth targets.

Stay tuned for the next article in our Localization Leadership series, where we’ll dive deeper into best practices for crafting effective localization messaging. Subscribe below, so you do not miss out!

Become a Great Localization Leader Today!

Sign up for our newsletter and stay up to date with monthly thought provoking insights, perspectives and tips from the industry leaders